By Tricia Lepofsky

Creating a comfortable retirement can be the biggest financial challenge you face when establishing a comprehensive financial plan. The good news is that if you are later in your career, you may have more opportunities to put more money toward your retirement accounts. Many retirement plans allow for catch-up contributions after you reach a certain age, which increases the amount you can put into accounts.

If you are 10 years away from retirement, focus on accumulation and maximizing your contributions to your retirement accounts. These are prime years where you are more likely to be earning your highest income and may have the ability to save the most as a percentage of your income; while at the same time, you’ve likely built a sizeable nest egg that is poised to take advantage of compound growth.

When closer to your ideal retirement age, say five years away, this is the time that you absolutely need to dig in. At KFA Private Wealth Group, we believe that there are a ton of moving parts when you reach the five-year point. When advising our clients, we like to organize these concepts into two main categories: Mindset and Math.

Mindset: Considerations

There’s a lot to think about when you envision the next chapter of your life, but try to organize your thoughts into the following categories so you can answer questions as to what the rest of your life will look like without being overwhelmed.

Your Transition Period

What does your transition look like? Do you want to cut down to part-time work while you ease into retirement or is consulting appealing to you? If married, will you retire at the same time or will one spouse work for a few more years? You also want to consider whether you will live in your current home or downsize. If you plan to downsize from a family home, take this time to repair and declutter your home so you can put it on the market easily when the time is right.

Your Retirement Plan and Purpose

You may want to talk to friends and family members who are retired to see what has been successful for them.

Also, take time to consider what you plan to do in retirement and ask yourself this question: Are you retiring from something or to something? Do you want to spend time with your family? Or would you rather spend time learning a new skill? You could also devote your time to a charity or civic organization. Having a purpose in retirement is really important, and once you outline your retirement purpose, you will have a clearer picture of what you want your retirement to look like.

Math: Calculations

Once you have the right mindset, you can start getting a better handle on the numbers. After accumulating funds in retirement accounts, it is also important to start allocating the investments properly in those last five years.

Examine Your Portfolio, Analyze Your Fixed Income Sources

This is a great time to evaluate the level of risk you’re taking in your portfolio. How much will you rely on your investments to fund your lifestyle? Are you taking too much risk or, maybe, not enough risk? There isn’t as much time to make up for any large mistakes now.

Regarding your pension and/or Social Security, you need to determine when you should start taking it. Once you have an idea of when you need to start taking it, you will better understand how much you will need from your retirement accounts at different stages of retirement.

Understand Core and Discretionary Expenses

It’s critical to get a good handle on discretionary expenses, such as dining out, and core expenses, like healthcare. You need to examine month-to-month expenses and evaluate long-term expenses, such as an upcoming wedding or anniversary party, as well.

Healthcare costs can be one of the more challenging aspects of financial planning. If you want to retire early, figure out how to bridge your private healthcare costs until you can depend on Medicare.

We’re Here to Help

While this may seem overwhelming, we are here for you. This is a process to work through over a series of years and not just one quick calculation. Switching from sourcing income from labor to sourcing income from capital can be daunting, so finding someone that can help you through the journey that you trust is priceless. Please email tricia@kfapwg.com or call 571-327-2222 to schedule an appointment.

About Tricia

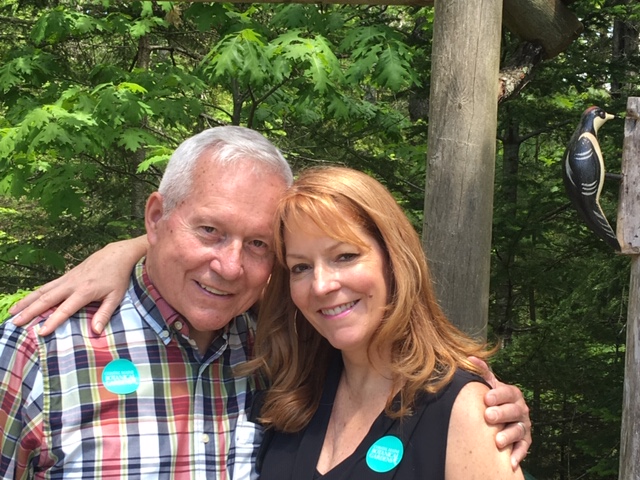

Tricia Lepofsky is a financial advisor at KFA Private Wealth Group, a registered independent advisory firm founded on the premise of providing sound financial and investment advice. With a background in music education and opera, Tricia transitioned to the financial industry to help people understand what their money can do and feel more in control as they work toward their goals. Tricia is known for her attention to detail and her dedication to her clients and their unique financial challenges. She is passionate about building relationships with her clients and partnering with them as they walk through life’s milestones, keeping them accountable and motivated to pursue their goals. While she serves a diverse range of clients, Tricia uses her background of 18 years in the Washington National Opera and Washington Concert Opera to specialize in serving hardworking, intelligent individuals who have a connection to the arts. In her spare time, Tricia loves to travel with her husband, Mark, hike trails along the Potomac River or in the Blue Ridge Mountains, and support former colleagues by attending live performances of operas and musicals. To learn more about Tricia, connect with her on LinkedIn.