By Tricia Lepofsky

Watching your parents age can leave you with many new responsibilities. Having a plan in place can relieve much of the weight off your shoulders in an especially stressful transition. My sisters and I are living through this scenario right now. Let’s discuss some legal and financial considerations that will make a world of difference for you and your family.

1. Get That Will in Place!

How many times have you heard a story in the news about a celebrity who died without a will and left their relatives and business partners with a raucous legal battle? Case in point: The battle over Jimi Hendrix’s estate continues to this day (more than 50 years later!) all because he had no will. (1)

While I like to consider my family above such squabbles, it’s better not to test that assumption. You never know how any amount of money will affect people and their behavior. It is important for your parents to have a will that spells out their final wishes, including who will carry out those wishes as the executor of their estate.

This is especially important in situations with blended families. It’s all too common for someone to neglect to update their will and leave an ex-wife or ex-husband as the sole inheritor or executor of an estate. Not only do your parents need a will, but they also need to make sure it’s updated to reflect their current situation and desired legacy.

The importance of double-checking beneficiary designations goes beyond just a will. Make sure your parents have reviewed all of their accounts, including life insurance policies, retirement accounts, and other savings, and verified that their listed beneficiaries are correct.

2. Start the Long-Term Care Conversation

If your parents are over 65, there’s a 70% chance they’ll need some sort of long-term care services in their lifetime. (2) That’s a high possibility that should be taken seriously.

Your whole family needs to come together to develop a plan for caring for your parents when the time comes. Discuss topics such as: Who will provide care for them? Who will pay for the care? Does it make sense for them to purchase long-term care insurance? Should they age in place or go into independent living?

All too often, the most responsible or local son or daughter ends up shouldering the entire burden. This can lead to burnout and resentment toward the other siblings. Save your family the trouble and proactively come up with a plan that everyone can agree on.

3. Assign Roles and Responsibilities

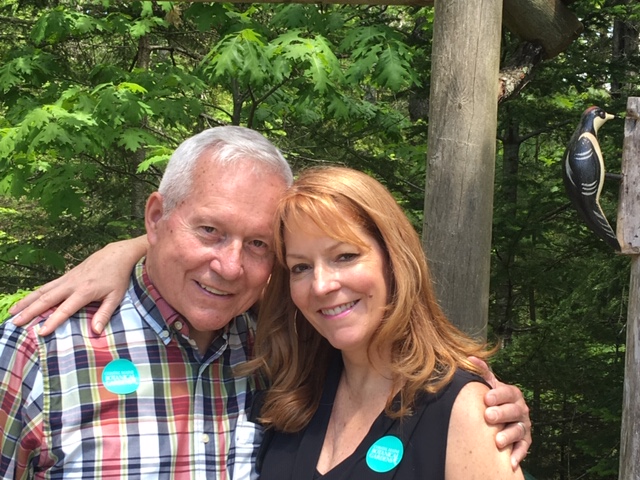

About 1 in 9 people age 65 and older have Alzheimer’s. (3) My Dad has it. He carries a note in his pocket to remind himself of the name of the disease or to let others read the note if he is confused. There’s a chance that a time will come when at least one of your parents is no longer able to make decisions for themselves. Who is going to make decisions for them at that point, both financial and medical?

While this can be an uncomfortable conversation, don’t avoid it. This is something you need to discuss with your parents and get the proper legal documents in place before they become incapacitated. Having simple powers of attorney written up will save you the trouble of going to court to request the right to help your parents when they need it most. If your parents are comfortable with it, it would be a good idea to have one or more of their children added to a bill-paying account. This way, if an emergency situation arises, they can access cash reserves to pay bills and debt payments immediately instead of waiting for assets to be released or legal documents to be enacted.

4. Invest in Your Relationship

While it’s important to have all the proper legal documents in place and have a plan for how to take care of your parents when they can no longer take care of themselves, the biggest regret for most people is simply that they didn’t make the most of their time with their parents.

We all know our time on earth is limited, so we need to spend it investing in those we love. As you watch your parents age, it’s a visual reminder that your time with them is coming to an end. Consider creating a routine to make sure you spend time with them frequently while you still can. Can you make a standing date for breakfast on Fridays or a phone call on Sunday afternoons? Carving time out of your busy schedule for your parents is one of the very best ways to enjoy these final years of their lives.

5. Enlist the Help of a Professional

To say the least, writing a will, planning care, and making these critical decisions (especially with all the emotions involved) can be overwhelming. And sometimes parents aren’t receptive to these difficult conversations with their children, the kids who at one time needed them to take care of their every need.

In a sensitive, vulnerable situation like this, where it feels like much is out of your control, it can be incredibly beneficial to work with an experienced financial professional, someone who knows the ins and outs of latter-year planning and can be a neutral third party in emotional family discussions. At KFA Private Wealth Group, we desire to help you feel in control of your family’s future, and we are dedicated to supporting, educating, and providing informed direction at each step along the journey. If you would like help planning for your parents’ future, email tricia@kfapwg.com or call 571-327-2222 to schedule an appointment.

About Tricia

Tricia Lepofsky, third daughter of Ann and Jesse, is a financial advisor at KFA Private Wealth Group, a registered independent advisory firm founded on the premise of providing sound financial and investment advice. With a background in music education and opera, Tricia transitioned to the financial industry to help people understand what their money can do and feel more in control as they work toward their goals. Tricia is known for her attention to detail and her dedication to her clients and their unique financial challenges. She is passionate about building relationships with her clients and partnering with them as they walk through life’s milestones, keeping them accountable and motivated to pursue their goals. While she serves a diverse range of clients, Tricia uses her background of 18 years in the Washington National Opera and Washington Concert Opera to specialize in serving hardworking, intelligent individuals who have a connection to the arts. In her spare time, Tricia loves to travel with her husband, Mark, hike trails along the Potomac River or in the Blue Ridge Mountains, and support former colleagues by attending live performances of operas and musicals. To learn more about Tricia, connect with her on LinkedIn.

_________________