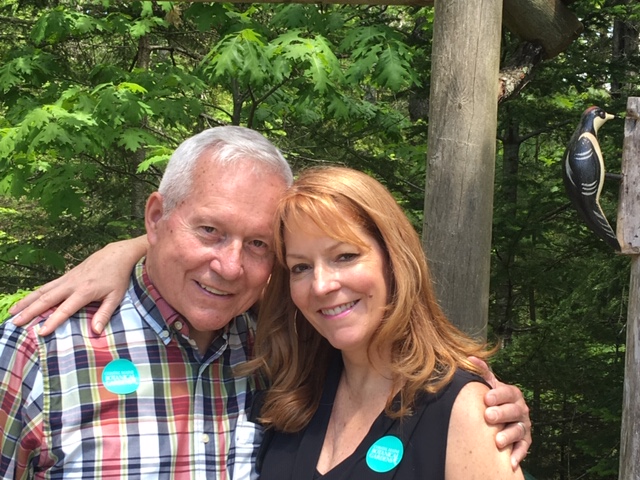

Dad sat in his comfortable recliner for his final three years. He could sit, eat, and doze without getting on his feet. In younger years, he was quite the storyteller until Alzheimer’s cruelly stole his words. He managed to hold court in his chair, surrounded by his family who filled in lost words, friends who already knew the stories, and patient caregivers. He used lots of hand motions, eye rolls, grunts, and smiles to convey his thoughts. On June 26, 2024, he died.

I am the youngest of Jesse’s three daughters and a financial advisor. The task of stretching a modest estate to incorporate my mother’s needs fell upon me. My competence in financial facts was shaken with the emotions of losing my Dad and watching my Mom grieve her husband of 66 years. I had sisters to answer to and a mother who was understanding less about money in her senior years. I turned off my grief and grounded myself in my financial training. What follows is a list pertinent to my mother’s situation and is not intended to be an exhaustive list.

A Financial Guideline After Loss

Because I am their financial advisor, I already knew my parents’ net worth, and I was familiar with their assets and liabilities.

My starting point:

- Get an inventory of assets and liabilities. This is imperative for the Executor to complete the process of setting up, processing, and closing an estate.

- Order original death certificates – get more than you think you will need. They take several weeks to arrive.

- Read the Will and/or Trust – it is the legal way that someone’s intentions are known. I encourage everyone to have one.

Maximize income for the surviving parent:

- Social Security Income – Widow(er)s may be eligible for benefits based on the deceased spouse’s earnings. My Dad had outearned my mother, so her social security stopped, and she started collecting his. Consider contacting your Social Security office immediately.

- Pensions and Retirement accounts – Check to see if the survivor is entitled to pension benefits. IRAs most likely have the beneficiary as the spouse.

- Required Minimum Distributions (RMDs) – if the deceased was required to take RMDs and had not taken their minimum distribution in the year they died, the spouse likely must still satisfy the distribution requirement.

- Annuities – Getting assistance in understanding them, cashing them out, deferring payments, or changing the beneficiary takes patience. I may have harshly yelled at many customer service agents until I could turn the monthly payouts back on in my mother’s name and surrender one annuity altogether. If you surrender an annuity, be aware of tax consequences.

- Joint accounts with rights of survivorship – These accounts are simpler when one person passes because the survivor has full rights to the money and can access it freely. Later, the accounts can be updated to a single owner, but having the flexibility to use the money immediately makes paying crucial, ongoing expenses easy

Understand and control expenses:

- Get Medicare premiums halted for the deceased.

- Downsize or sell assets. Selling an extra car or downsizing the home may alleviate ongoing financial burdens for the survivor. You will have to weigh the survivor’s memories and love of their home, and the physical and emotional disruption of moving. A house can be sold within two years of a spouse’s death and still qualify for the $500,000 exclusion of capital gains. If you wait longer, the survivor can only exclude $250,000 of capital gains. We left Mom in her apartment, but Dad’s treasured 1969 MGC Convertible was sold.

- Uncover any pre-paid funeral plans or pre-paid cemetery plots to utilize.

- Consider giving access to checking/savings accounts to a highly trusted relative. My Mom shared that she is relieved that I watch over her accounts and that I move money from her brokerage account to her checking account as needed. I also watch for any unusual transactions.

Manage lifestyle adjustments:

- Reducing expenses was imperative to ensure my Mom’s long-term stability. Evaluate housing, discretionary spending, and medical expenses. I became the watchdog of spending. A generous parent is not easily persuaded to be less charitable. It was an uphill battle. Parenting a parent is uncomfortable for everyone.

- Power of Attorney (POA) – Talk to your parents early about getting a POA while they are mobile and have full mental capacity. A POA will be needed at some point when Mom or Dad cannot speak for themselves.

Consider working with a Financial Planner. Their logical and objective approach can set you up for financial success, and the relationship you build can help you in emotionally difficult times as well.

On a recent visit, I briefly sat in Dad’s recliner, hoping to feel his presence. All pictures of my Dad are turned to face the person who sits in his chair. It is no surprise that my Mom sits there daily.

The opinions expressed herein are those of KFA Private Wealth Group and are subject to change without notice. KFA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided is for educational and informational purposes only and should not be considered investment advice or an offer to sell any product. Past performance is no guarantee of future results. This contains forecasts, estimates, beliefs and/or similar information (“forward looking information”). Forward looking information is subject to inherent uncertainties and qualifications and is based on numerous assumptions, in each case whether or not identified herein. It is provided for informational purposes only and should not be considered a recommendation to buy or sell securities or a guarantee of future results. KFA is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about KFA, including our investment strategies, fees and objectives can be found in our ADV Part 2, which is available upon request.